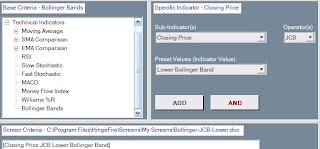

The overview below describes one of the common technical indicators – Bollinger Bands and provides insights on how to utilize it in your stock selection. Hopefully this outline will provide traditional fundamental investors with some solid insight on how to incorporate technical indicators into their screening. The free HingeFire Stock Screener which can be found at http://www.hingefire.com is one of the few tools available that includes a wide selection of fundamental and technical criteria for selecting stocks. Using a combination of fundamental and technical screening is a powerful tool for winning in the market.

Bollinger Bands

Bollinger Bands Overview

Bollinger Bands were created by John Bollinger in the early 1980s. The intention of Bollinger Bands is to allow the dynamic comparison of volatility and associated price levels over time.

Bollinger Bands are created by taking a 20 day SMA average and then placing two bands, one above and the other below, at two standard deviations away from the central SMA line. These bands are drawn on the same chart as the stock price.

The lower Bollinger band normally marks a support level while the upper band defines resistance. Many times a dropping or rising price level only crosses outside the bands for a single day. In some sense most stocks are not more volatile than the bands associated with Bollinger, any price outside the band is likely to quickly revert to a level inside. One exception are situations in which the equity price is quickly rising and falling, and the bands “open up” as the volatility increases.

The HingeFire tool

How to use Bollinger in screening

Most investors utilize the crossovers above the upper Bollinger Band or below the lower Bollinger Band when screening with the indicator. Bollinger crossovers represent volatility extremes, and usually imply that the price will snap back shortly. Many times these serve as excellent short-term entry points when confirmed with other indicators.

Another common method to screen with Bollinger is to scan for stocks that are outside the upper and lower bands. This will catch stocks that have been in these extremes for more than a single day.

Crossing above the upper Bollinger

The upper Bollinger Band serves as a resistance level. Stocks whose prices rise above this level tend to snap back below it, many times in under a single day. This is especially true in situations where the bands do not “open up” due to increased volatility. If the Bollinger Bands remain steady in width then if is likely that the price increase above the upper band is short lived.

AANB (Abigail Adams National Bancorp Inc.)

Crossing below the lower Bollinger

The lower Bollinger Band acts as a support level. Normally when the price of a stock falls below the lower band, it tends to revert back above it. The cross below is of interest because this event many times lasts only a single day and serves as a good long entry point in some situations.

GWR (Genesee & Wyoming Inc.)

Price above upper Bollinger

Sometimes the price can rise above the upper Bollinger Band for several days before retreating to inside the band. This usually occurs in scenarios where the band rises and widens with the increase in the stock price and volatility.

EEQ (Enbridge Energy Management LLC)

Price below lower Bollinger

In some situations, the price of a stock can drop below the lower Bollinger Band for several days. This usually occurs in scenarios where the stock price is in free-fall and the band widens to accommodate the increasing volatility. Normally the price will revert inside the band after a few days when the selling momentum dissipates.

A recent scan using the HingeFire tool found that WYE (Wyeth)

Bollinger Summary

By themselves, Bollinger Bands do not normally generate pristine buy and sell signals. It is best to cross correlate information from Bollinger with other technical indicators before taking action. On a chart, Bollinger Bands are excellent for identifying periods of high and low volatility, as well as extreme pricing levels.

Many investors utilize Bollinger to look for divergences in stock price and the volatility of the bands. A small number of investors try to set different Bollinger periods and standard deviations on charts to match the particular equity under evaluation. However the traditional 20 day Bollinger with two standard deviation bands is normally the best for intermediate term studies.

The HingeFire tool supports users in screening for the following situations with the Bollinger Band indicator:

- Crossing above the upper Bollinger.

- Crossing below the lower Bollinger.

- Price above the upper Bollinger.

- Price below the lower Bollinger.

Combining technical indicators such as Bollinger Bands with commonly used fundamental criteria and technical indicators when selecting your investments helps put the market edge in your corner. The Bollinger support in the HingeFire Stock Screener adds a powerful tool that enables the searching for volatility-related extremes which will improve the timing of your market transactions.

0 comments:

Post a Comment