Amidst all the carnage in the financial sector, how can you screen for the stronger banks and financial institutions that are likely go come out of the credit crunch as leaders.

The best starting point is creating a screen that searches for potential candidates. The key question is what criteria should be in this screen. Basically you need to hunt for financial institutions that display the following characteristics.

- The earnings are still positive.

- The yield is above 0.5%.

- The bank stocks trades at reasonable volume above a price of $2

- The bank stock price performance is exhibiting strength against both the S&P 500 and the bank stock index over the past 3 and 6 month periods.

- Technical the bank is exhibiting positive moving average trends in the short term and the rate of change is positive.

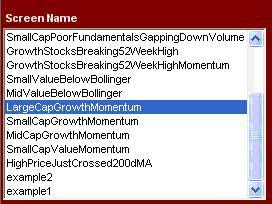

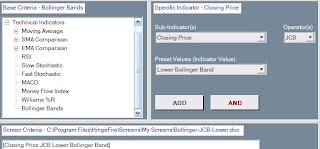

A basic bank screen that meets the points above can be created within HingeScreen. A user can go to create mode and add the following criteria. In this case, we are searching for financial institutions priced above $2 with volumes over 10K that have outperformed the S&P 500 and KBW bank index. The trailing dividend yield must be above 0.5% (forward yield can also be considered). Technically the rate of change (ROC) must be positive, while the recent 20 day moving average must be above the 50 day. These technical points will show a recent positive trend in stock pricing.

The screen is saved as BankScanOne.

The next step is to jump to Execute Mode and run the screen. The results align with expectations; it is a mix of stronger regional banks, REITs (primarily with a healthcare focus), and some financial service organizations.

The stronger banks in the results such Valley National Bancorp NJ (VLY), and Wilshire Bancorp (WIBC) are examples of regional institutions that avoided obscene mortgage lending and maintained their balance sheets in good order over the past few years.

The majority of the REITS that show up in the results such as Health Care Property (HCP), Health Care REIT (HCN), and Healthcare Realty Trust (HR) are examples of REITS that are focused on stronger market segments and have easily avoided the worse aspects of the real estate downturn.

A few financial service organizations such as Northern Trust (NTRS) and PNC Financial Serv. (PNC) also show up in the results. A number of players providing financial services have used the downturn to strengthen their offerings and market position.

Using HingeScreen it is easy to save the results to a spreadsheet for further evaluation. Simply press the button on the right that looks like a floppy disk and the results are saved to a spreadsheet format file that can be opened using Excel. By default the saved result files are placed in the C:\Program Files\HingeFire\Results directory.

HingeScreen is a powerful tool to find stocks that meet the performance and diversification needs for your portfolio. It is useful for identifying candidates that are likely to come out of a downturn as leaders in a sector. HingeFire provides an excellent video library outlining how to use the tool at: http://www.hingefire.com/Education/KnowledgeBase/HingeVideos.aspx