Most investors continually search for the next “ten-bagger” which will explode with enormous returns. Many of these opportunities are found in small company stocks. Typically small caps as a group outperform larger companies. However significant risks must be navigated when selecting individual small cap stocks.

A dearth of analyst coverage means that small-cap stocks are more likely to be priced inefficiently. The majority of the growth and stock price acceleration occurs when companies are still small. Most institutional investors avoid small caps, at least until they grow larger; this leaves many small caps as yet undiscovered champions.

While the market has taken a dive in recent weeks, there are still a number of small cap stocks that appear to offer excellent growth potential. The recent market turmoil has the advantage of now offering these stocks at a discount from previous prices.

Several growth oriented small caps show outstanding potential for future returns. In the hardware, software and service sectors, five promising candidates include; Concur Technologies (CNQR), HMS Holdings (HMSY), Sigma Designs (SIGM), Synchronoss Technologies (SNCR), and Synaptics (SYNA).

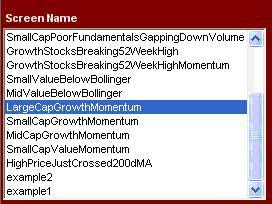

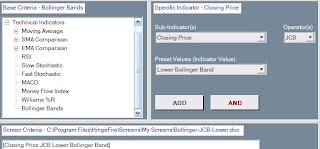

These stocks were initially found in using the HingeFire stock screener to search for growth-oriented stocks capitalized between 500M to 2B. Further comprehensive assessment revealed strong balance sheets, growth outlooks, and stock price potential for these companies. Importantly, the firms also have the attractive attribute of being engaged in rapidly growing market segments.

Concur Technologies (CNQR)

Most companies are going to great lengths to reduce employee travel and business expenses. In many cases, the reporting of this non-core activity is being outsourced to outside firms or companies utilize third party software packages to track this information. Concur Technologies is a leading provider of employee spending management solutions.

The business of outsourced travel and entertainment accounting is expected to grow to $7 billion over the next five years. Concur Technologies is positioned directly in the middle of this growth segment.

Concur Technologies recently acquired its primary competitor, Gelco, through the acquisition of H-G Holdings in a $160 million cash deal in October. The firm has a 1.3 billion market cap with a 2008 sales estimate of $200 million. The company has minimal debt and strong operating cash flow.

Even at $30, Concur is not cheaply priced. The company sports a trailing P/E of nearly 150 and a forward P/E of 50. CNQR will have to execute perfectly to hit expectations of growth and earnings to maintain these rich valuations. However there is a strong belief in the analyst community that the company will hit the expectations of 55% growth expectations for revenue and income.

Concur Technologies shows the attributes of a stock with exceptional price potential – a strong balance sheet, excellent growth prospects in a booming industry, and a history of solid execution.

HMS Holdings (HMSY)

HMS Holdings Corp recently hit 52 week highs. The company provides cost containment and coordination of benefits to government healthcare programs. The administration and cost containment of healthcare benefits in the United States has become an increasing concern for government agencies. The outsourcing service market for this activity has experienced solid growth over the past years, which is expected to continue into the future.

HMS Holdings is experiencing increasing analyst coverage, normally a positive sign for a company. Bank of America Securities recently initiated coverage.

The company has an $850 million market cap with minimal debt, solid cash flow, and recent revenue of $138M. The trailing P/E of 70 and forward P/E of 45 shows that the firm is handsomely valued, however the recent quarterly revenue growth (78.7%) and earnings growth support these high expectations.

HMSY has a history of increasing guidance in its conference calls as it did in the recent Q3 call when it announced raising the 2008 full year revenue guidance to $170 million, an increase of 17.2% above 2007 guidance, and adjusted EBITDA to $49 million, an increase of 22.5% over 2007 guidance.

HMS Holdings has to navigate a maze of government regulations while providing coordination of benefits and cost containment to agencies, however this is a service that the government very much needs and the firm is excellent at providing. With the U.S government continuing to increase this type of outsourcing activity, the potential for HMSY stock looks bright.

Sigma Designs (SIGM)

Sigma Designs, Inc. is best known as maker of microprocessors for digital media products such as DVD players, set-top boxes and high-definition televisions. The company has a dominant market share in IPTV and HD DVD; these two markets are expected to explode over the upcoming years as more video is provided over the Internet and the United States broadly rolls out high definition television.

Sigma Designs faces growing competition from other players such as Broadcom Corp. (BRCM) and Zoran Corp. (ZRAN). However these competitors have not eaten into their growth or margins. Sigma Designs reported third-quarter sales of $66 million, a 56% sequential growth, easily trouncing Wall Street projections.

The company has reasonable P/E ratios (trailing: 26.74 / forward: 14.9), excellent earnings growth, no debt, a growth estimate over 29%, and a market cap of $1.14 billion. For a technology company in hot market segment, it is hard not to view Sigma Designs as an exceptional value. A recent company investor presentation can be found at Sigma Designs Investor Presentation – Jan 2008.

Synchronoss Technologies (SNCR)

Synchronoss Technologies is more than just an iPhone activation story. The iPhone release was a great setting for Synchronoss to demonstrate to mobile carriers what it is capable of doing. This is likely to prime the pump for many other carriers to pick up their on-demand, multi-channel transaction management solution technology.

With the iPhone activations fueling it, AT&T (T) generated 78% of the firm's revenue in the recent quarter, so diversification of revenue source is a significant concern for investors in this company. Making inroads in the carrier market takes time; however Synchronoss is seeing traction with Clearwire, Cablevision, and Vonage (VG). It is expected that the company is also working with overseas carriers such Deutsche Telekom's T-Mobile, France Telecom's (FTE) Orange, and Telefonica's (TEF) O2 on rollouts of the iPhone in foreign markets.

For the third quarter, Synchronoss reported net income of $8 million, or 24 cents per share, compared with $3.1 million, or 10 cents per share, last year. Quarterly revenue jumped to $34.5 million from $18.9 million. The company has a market cap of $736M, minuscule debt, a forward P/E ratio under 25, good cash flow, and a history of excellent earnings growth in 2007.

The long term success of Synchronoss is dependent on its ability to penetrate other carrier accounts beyond AT&T with its management technology. Investors should focus on announcements of additional carriers deploying the solution. Assuming that SNCR makes these inroads, the stock price is likely to climb significantly from the current levels.

Synaptics Incorporated (SYNA)

Synaptics Incorporated develops user interfaces for mobile devices like notebook computers and cell phones. Dominating the market, Synaptics makes 60% of all touch pads for portable computers and has a customer list which includes 9 of the top 10 notebook vendors. IDC has forecasted annualized growth of 16.1% for notebook PCs from now until 2010. Synaptics also has excellent presence in the handheld market, including design wins for Apple (AAPL) Nano & Classic iPods and several new smartphones.

Synaptics recently endured an analyst downgrade from American Technology Research analyst Jeff Schreiner who downgraded the stock to "Neutral" from "Buy’ citing a slight loss in market share and the expectation of lower 2008 revenues. This drove the stock to a recent low of near $30, making the pricing attractive.

The company shows a trailing P/E of 25.89 and forward P/E of 10.43 leading to a small 0.83 PEG ratio. Both ratios are small for a tech sector stock. With low debt of $125M, a market cap of $950M, respectable cash flow, and history of earnings growth, SYNA has solid prospects.

The crucial question will be if the company can maintain its user interface market share dominance while growing sales at an exceptional rate over the upcoming couple of years. Assuming the company will hit or exceed the analyst projections; the stock price has significant potential to increase from the current levels.

Summary

As always - investing in small caps involves risk. Not all projections for colossal growth always pan out. Some small cap stocks will turn into the next “10-Bagger” which you will brag to your friends about for years, while others will fade into oblivion. The key is to screen for potential candidates, investigate them fully, and spread your “bets” across several stocks when seeking over-sized growth. There are never any sure winners, but solid research can put the market edge in your corner.

Disclosure: The author does not have a position in any of the equities mentioned in this article. The information provided does not constitute a solicitation to buy, or an offer to sell securities.